Why we believe India can become the next manufacturing hub

India well positioned to become an attractive investment destination

Source : Internal Assessment

Thriving Domestic Demand

- Per capita income at an inflection point

- Rising middle class population

Favourable Policy Reforms

- Initiative to incentivise domestic manufacturing

- Labour reforms and ease of doing business

Robust private sector

- Deleveraged corporate sector

- Globally competitive corporate tax structure

Alternative supply chain

- Globally competitive business

- Repositioning of global supply chains

Canara Robeco Investment Universe 335 stocks

Fund Universe (Manufacturing & Allied Stocks) 227 stocks

Portfolio

AllocationMinimum 80% into

manufacturing & allied stocks

Portfolio

ConcentrationDiversified Portfolio

Market

Capitalization BiasFlexible across

Market capitalization

Investment

StyleGrowth biased

Stock

SelectionTop-Down Overlay +

Bottom-up Stock Selection

Note : The fund strategy is based upon our current fund management/ investment strategy. However, the same shall be subject to change depending on the market conditions. Investors are requested to refer SID for more information on Asset Allocation & Fund Strategy. Stock Universe is as on December 31, 2023.

Note : There is no assurance or guarantee that the investment objective of the scheme will be achieved.

Seek to become a part of the India Growth Story by investing into Canara Robeco Manufacturing Fund.

The Fund aims to invest in companies which are beneficiaries of Thriving Domestic Demand, Favourable Policy Reforms, Robust Private Sector, and Alternative Supply Chain.

The Fund aims to capitalize on manufacturing trends and opportunities investing across relevant sectors representing the Manufacturing theme.

Government thrust on “Atmanirbhar Bharat”, “Make in India” and through other reforms and incentives has improved growth potential of many manufacturing-oriented sectors and companies.

Note : There is no assurance or guarantee that the investment objective of the scheme will be achieved.

- 01

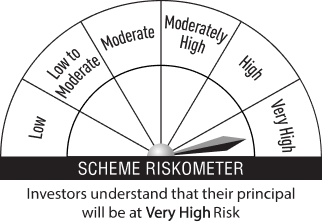

Investors that are comfortable with volatility & expecting a better risk return tradeoff.

- 02

Investors with a high-risk appetite and long-term investment horizon of 5 years and above having a lower near-term liquidity needs.

- 03

Seasoned investors who are looking to invest in a manufacturing theme-based fund.

Note : There is no assurance or guarantee that the investment objective of the scheme will be achieved.

| Name of the scheme | Canara Robeco Manufacturing Fund | ||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Type | Thematic - Manufacturing - An open-ended equity scheme following Manufacturing theme | ||||||||||||||||||||||||

| Investment Objective | The scheme aims to generate long-term capital appreciation by investing predominantly in equities and equity related instruments of companies engaged in the Manufacturing theme. However, there can be no assurance that the investment objective of the scheme will be realized. | ||||||||||||||||||||||||

| Asset Allocation |

| ||||||||||||||||||||||||

| Plans & Options | Regular Plan & Direct Plan A) Growth

| ||||||||||||||||||||||||

| Fund Manager | Pranav Gokhale & Shridatta Bhandwaldar | ||||||||||||||||||||||||

| Load Structure | Entry Load: Nil Exit Load:

1% - if redeemed/switched out within 365 days from the date of allotment. | ||||||||||||||||||||||||

| Benchmark (First Tier) | S&P BSE India Manufacturing TRI | ||||||||||||||||||||||||

Note : Under normal circumstances, the asset allocation of the scheme will be as per above table. Investors are requested to refer sid for more information on asset allocation

For KIM

Click Here For Direct Plan

Click Here For Regular PlanFor Scheme

Click Here

Information DocumentFor Product

Click Here

PresentationFor Product

Click Here

Leaflet

Canara Robeco Manufacturing Fund

An open-ended equity scheme following Manufacturing theme